I want to share little bit of math behind this blog name – Project2035. At that time I will turn 50. To think I will be half century old by then. Half a century… 🙂 Pension age at my country is 65 years. Due to improvement of medicine and average living duration I can bet that it will be at least 70 years when I will reach the pension and that is 2055… People should be living in Mars by then 🙂 Just imagine how world will look by then. Did you imagined that we will have PC and smart phones at 1970’s? But this post is not about futurism and stuff like that.

So my main goal is to become financially independent till I’ll reach half century of till Y2035. I have come up with this simple chart which explains how should I reach it. Financial independence is when you Passive income exceed your expenses. In order to reach it we have to increase our Passive income and decrease (if possible) our expenses. First one I’m planning to achieve trough my Investment portfolio which will generate me a steady stream of Dividends or Passive income. So that’s for theory, what about the actual figures. Let’s calculate were we will end up in thous 18y from now using such such math:

So my main goal is to become financially independent till I’ll reach half century of till Y2035. I have come up with this simple chart which explains how should I reach it. Financial independence is when you Passive income exceed your expenses. In order to reach it we have to increase our Passive income and decrease (if possible) our expenses. First one I’m planning to achieve trough my Investment portfolio which will generate me a steady stream of Dividends or Passive income. So that’s for theory, what about the actual figures. Let’s calculate were we will end up in thous 18y from now using such such math:

- 200 EUR/mo. steady investments into shares.

- Shares pay me averaged 4% (actual 4,3%) of dividends after tax.

- Dividends increase by +5% each year.

- Dividends are reinvested into shares.

- 170 EUR/mo. is invested into II and III pension funds.

- +3% pension fund growth annually.

- Pension fund money is invested into shares generating 4% dividend at Y2035.

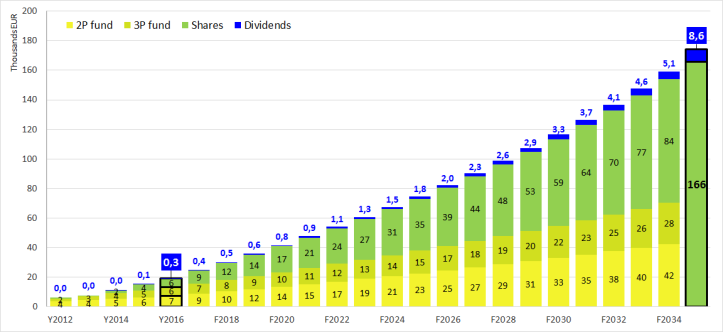

So here is the result of my portfolio development in coming 18 years:

So our investment portfolio should increase from 22 kEUR at the moment to around 166 kEUR and should generate nearly 9 kEUR dividends / year, which equals to around 720 EUR / mo. of passive income. This looks a bit low knowing that our present income is around 1.5 kEUR and expenses 1,3 kEUR out of which around 830 EUR are fixed expenses. So in general present saving and investing is not sufficient to retire before i’m 50 🙂 Will have to think something else to boost our passive income then 200 EUR/mo. investing into dividend paying shares, but never the less even under present circumstances we should be able to live out of projected passive income on bare minimum, so financial independence is already reachable by Y2035 without changing anything today 🙂

Hey!

Do you take into account the inflation?

Usual calculators for FIRE uses 3%. So, for example, if you expect to make on average 7% from index funds. You will calculate that you are actually making 4%, because you must keep 3% to enable your principal to have the same buying power.

Let’s assume that you need 100 000€ to retire, and it will take 18. Then your final amount is 100 000 (1+0.03)^18 = 170243 €.

That means that in 18 years, you would need to have 170k instead of 100k, to generate the same amount of money.

LikeLike

Yes and no 🙂 As you can see in my calculation I use 3% growth (conservative) for funds. Also dividend growth is 5% whitch is also lower then average. Maybe durring that 18y a correction will come and I will be able to get dividend yields of +5% that was present in y2009-2010 🙂 Now everything looks a bit overevaluated. But you are right that 700€ in 2035 worth only 400€ in todays money 🙂 Either way 200€/mo is not enough 😦

LikeLike

Seeing that 3% growth, I was thinking that you might be already using a number after adjusting for inflation. So, this part is all good.

As for dividends. Let’s assume you invested 1 000€ and getting 5% dividends, which are 50€. Next year dividends grow by your number of 5%. So 50€ * 1.05 = 52.5%.

However, 2.5 is only 0.25% of your invested amount. So, either your capital needs to be climbing by 3% on its own, plus keep paying 4-5% dividends (which would be the same as investing in index funds), or your wealth will be decreasing.

Yes, your dividend payout would be adjusted for inflation, however, your capital wouldn’t.

So, everything might work out, but capital gains must happen for dividends stocks as well of ~3% percent a year, which will probably happen (in this case your dividend return, based on the capital worth will reduce in percentage, but the actual euros will work out well).

LikeLike

Ah good point regarding capital gain. So we should be a bit more richer at Y2035 then that 166 kEUR that I calculated 😀 But you never know. Mr. market might take a good dip by them while dividend income should be stable 😉

LikeLike

hello. to lot calculation. life is not only numbers…to long time, until you reach 50. Try to invest forex or something

LikeLike

Certenly not. Did you sae our y2017 goal #1? Its definatly not about numbers 😉

LikeLike

Forex could have great returns, tho. Majority of my portfolio is allocated to the forex market, it’s stressful, but it pays off.. 🙂 Also, there are some risky EAs (robots), that could make the trades while you sleep 😉 (will be probably doing something like that pretty soon)

LikeLike

yeh but that not for me 😉 Not saying not good instrument, but nor for me.

LikeLike

i think, your portfolio needs diversification: shares, forex, p2p, later-real estate…I like dividens, but they’re very low, according inflation.

LikeLike

RE yes, p2p (as I understood lending) maybe, forex no as I don’t see how they generate return. If you hold USD or SEK or some other currency, that does not generate any income. But at first I need to build up some sort of share portfolio. Maybe when my share portfolio increase to 20 or 30 kEUR, then I will think about diversification 🙂 But good point either way.

LikeLike

Looks like it’s pretty solid calculations. I like it. I am definitely excited about where technology will take us in the future. Should be fun to see what the future holds.

LikeLike

Thanks MSM 🙂 I have faith in humans so hope that worst case scenarios like in films Mad max or Terminator will not materialize 🙂

LikeLiked by 1 person

Have you ever thought of investing into P2P? It generates nearly 15% after taxes and defaults. It’s stable and a long term investment. However, it have some risks!

LikeLike

Yes, but this is a risky instrument. Its like a deposit in a fast credit bank and without state guarantee. Not sure if in L/T it is very stable. I think this would default first when recession hits. Remember P2P platform clients are the ones that got no for borrowing from the bank.

LikeLike

There is the reason why it’s 15% 🙂 The more risk you take, the bigger possible payout. But at the same time, the bigger possible loss.

Also, the loan market should start to mature slowly. For example, in UK p2p gives 3-4% only. So, I expect profits to keep going down for p2p in Lithuania.

What I mean with that, that it can be used only as a short term strategy. The author is aiming for a long perspective.

LikeLike

Yes and I dont like the p2p in general. I realy doubt that people borrow in p2p if they can borrow at the bank cheaper. And then this leads to who borrow at p2p. Sorry if being rude but this is leftovers from banks. Bad clients who should not get a loan at all. This leads to same toxic bond scenario that made 2008 crisis. I thing p2p lending is a bad thing in general and straight path to overheating the economy with unregulated lending.

LikeLiked by 1 person

I couldn’t click reply on your comment, so replying to my own (probably maximum comment nesting level reached).

I believe that many people are on p2p platforms because banks don’t loan them.

However, I’ve tried to loan money myself from banks both in UK and LT. That’s just not really possible unless you are buying house/car, or ready to pay 20% on your credit card.

For example, last time in UK I was wondering, could I borrow 10 000£. So, clicked in the online banking platform some buttons, and was suggested 10% interest rate.

I mean that’s nuts, I live alone and my income is double when country’s average. I have no problem returning such a small loan in 3-4 months in full, but would need to go p2p way, because there is no other possibility. Banks want to make you poor instead of helping you.

Also, many many years ago, wanted to borrow the similar amount of litas from Swedbank. Did the application, which was rejected, because my reason “to buy stocks” was not good enough for them.

So, I DO understand why people go to p2p platforms even if they are more than capable of returning the money to the lender.

LikeLike

But p2p platforms dont lend you for lower then 10%. Consumer loan is not the instrument for stock purchse. Your banker was not advance enought to say that there is lending with pledge of shares. Not sure if its advanced enough in Lithuania though, but there is this leverage and rap instruments for share purchase. Anyway buying stocks with consumer loan is not logical. You can earn 5% dividend at max other is speculation, and banks cant give you loans for speculations with stocks, land plots, even apartments. This is what called prudent banking. Banks realy dont want you broke, because then your problem becomes bank problems. I saw that from close back in 2008-2010.

P2P platforms on the other hand is wild jungle there is no rules and unregulated liberalism already got us into two major crisis back in 1930’s and in 2008.

LikeLike

I was suggested 10% in UK, not LT. RateSetter gives 2.5-3.5% rates (UK). I mean as for an investor. Not sure what exact rate is to actually borrow, but sure that will be less than half of that 10%, i.e. <= 5%.

That's why in my earlier comment to "savaitgalio emigrantai" said that 15% won't be for long. The same happened in UK, USA, and I firmly believe that the same will follow to happen in Lithuania.

As for LT case, I didn't want to lock my shares, I wanted a simple consumer loan, the one which is backed up by nothing. Solely, based on my ability to earn money and repay (plus not having other loans). This is a normal bank practice. Just the interest rate is higher than in a mortgage case.

Buying stocks with consumer loan was very logical on given specific circumstances. The stocks in the Baltic market were still below pre-crisis level. So, I was sure to get my returns on investment. In other words, was ready to take the risk and pay the bank if I were to fail.

If there was another crisis, I believe I would try to borrow money to buy index funds even with 10% interest rate. Even if I were to borrow 100 000£, I would need to pay only 10 000 extra a year. Meanwhile, my gains could be 50-100k easily. Plus dividends paid before getting capital gains.

LikeLike

I think the dividend stock investing for retiring is a bad strategy. At your age i think the stock portfolio should be 10-20%, another 10-20% Loans and the rest should be devoted for creating your own business. Think of putting 2000€ instead of 200€ into investments – how does that change your calculations?

LikeLike

Well bussiness is not for everybody 🙂 Tried some, but it did not worked out, but you never know. I like analysing comapnies so these investments is not something that im going to get rich. Its something simular to antique collecting. You buy part of some company and see how they are doing. This slow growth fits my personality. I dont know maybe I could do farming, that would be the best bussiness type that fits my personality, but my wife is against so all I can grow is small parts of companies 🙂

LikeLike

Wow, it’s nice to see that there are some fellow Lithuanians who are trying to reach Financial Independence – I thought it’s not that popular.

I love the fact that you chose dividend growth companies to try and reach it. Even though it might not be the quickest way to reach FI, I think it’s one of the most stable ways and it does not require a lot of effort from your end (except deploying capital monthly in the accumulation phase).

Keep up good work and it will be interesting to follow your journey!

LikeLiked by 1 person

Thank you for your kind words 🙂 We will see how it goes. So far the saving and investing rate is to small, but we are going to the right direction at least 🙂

LikeLike

I think P2P is a nice instrument if diversified well. You can also invest to SME loans for short term and manage the risk well and still get double digits return post tax. 🙂

LikeLike

Hi Honeatfire. Thanks for droping by. I have a very sceptical view on P2P lending. In general these are junk loans that banks have rejected. Also these platforms are doing economy overheating when giving money that in generel should not be lended to. It is not good for economy sustainability. I think there will be +50% default of these loans when recesion comes so im out of it.

LikeLike

Depends. 🙂 Banks don’t offer loans to SMEs in Lithuania and there’s a gap in financing for them that FinBee Verslui is taking. Also Lietuvos Bankas has set 40% income/instalment limit that works as an extra safety. 🙂

LikeLike